What is DORA?

The Digital Operational Resilience Act (DORA), is a European Union (EU) regulation that aims to strengthen the digital and IT security of EU financial institutions to ensure Europe’s financial sector remains resilient to operational risks and disruptions.

Launched in January 2023, and coming into full force in January 2025, DORA provides a comprehensive and unified set of information and communication technology (ICT) risk management standards that all EU financial institutions must follow.

Who Must Comply with DORA?

All financial institutions in the EU must comply with DORA — including banks, insurance companies, investment firms, and other financial entities. DORA also applies to various third-party service providers that financial institutions utilize for ICT systems and services (such as data centers).

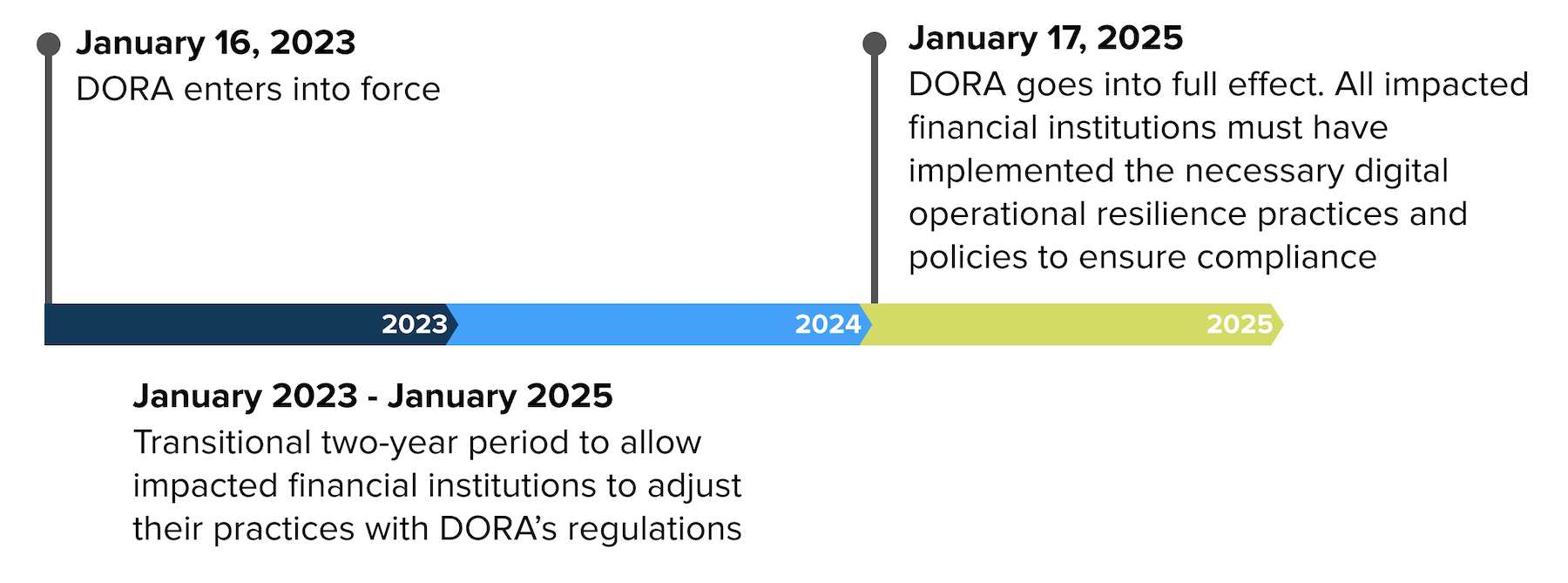

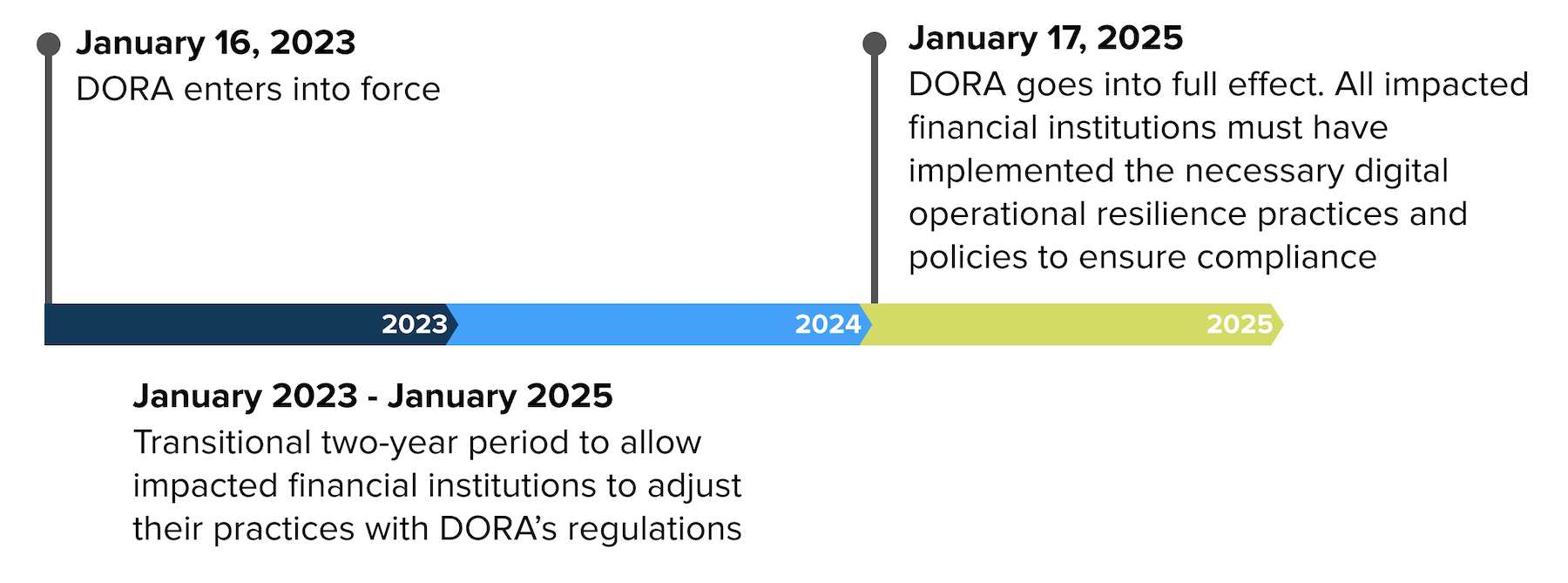

What is the Timeline of DORA?

DORA is being rolled out according to the following key dates:

The Burden of Manual Compliance Processes

While some organizations may have operational or cyber resilience processes in place to address DORA compliance, they are often manual in approach, quickly outdated, and siloed across teams — which frequently leads to higher operational costs, lower accuracy and effectiveness, and greater risks of human error.

- Expensive Labor: Requires large amounts of manual labor, time, and costs — either in the form of internal resources, or external consultants.

- Greater Risk of Human Error: Increases risk of human error due to oversight, loss of tribal knowledge or miscommunication across business units

- Outdated Inventories and Risk Assessments: Periodic identification, mapping and risk assessment exercises result in outdated information used to manage operational change, recover from incidents and respond to emerging risk conditions.

- Increased Financial Exposure: The risk of failing compliance audits or being unprepared for an incident results in extremely expensive penalty fines, as well as reputational damage